Unlock returns on your money with seamless access to your funds whenever your business needs it. Exclusive to eligible Aspire customers.

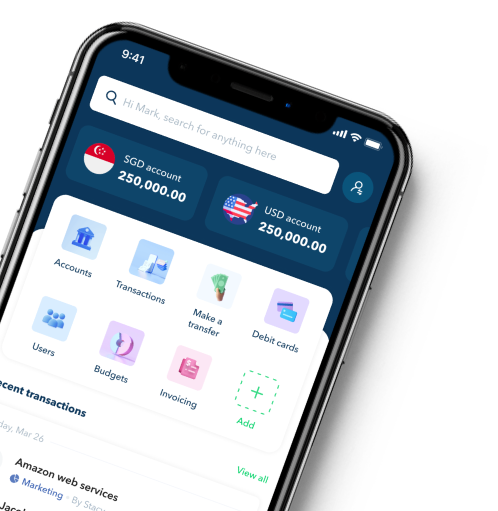

Automate business expense management without losing control

Improve your finance operations with our integrated expense management solution. Use instant corporate cards, streamlined claims, and robust spend controls to optimise processes, gain real-time visibility, and ensure in-policy spending.

.webp)

Trusted by 50,000+ modern businesses

For happier employees, managers, and finance teams

Empower your team

Equip your team with unlimited corporate cards, democratising purchases for faster, secure, and distributed procurement to contribute towards streamlined expense management

Real-time control

Effortlessly monitor all spending across cards and claims in real-time. Ensure in-policy spending with built-in controls to keep expense in check

Automate reconciliation

Eliminate manual admin for the entire team with centralised software and powerful accounting automation that drastically streamlines expenses

Eliminate the hassle of manual work

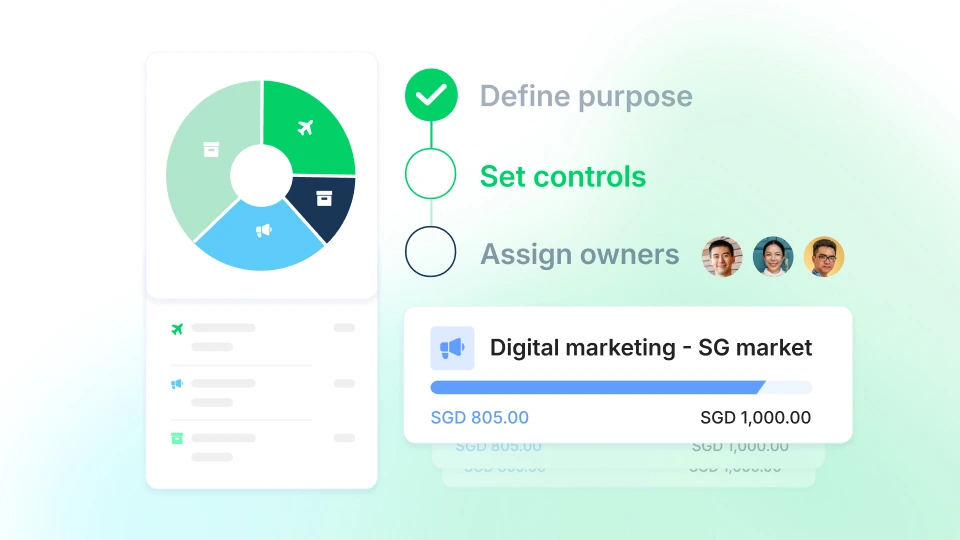

Keep spending organised with budgets and spend policies

Enable tighter control by creating budgets at the client, project, or team level

Budget owners can add budget members to manage spending within their own teams or projects

Ensure compliance with spend limits and gain real-time visibility into all employee expenses

Issue corporate cards for greater control

Issue unlimited virtual cards for every use case, subscription, or employee to keep finances organised

Keep card spend in policy with adjustable spend limits and merchant locks. Update settings, freeze, or cancel cards anytime

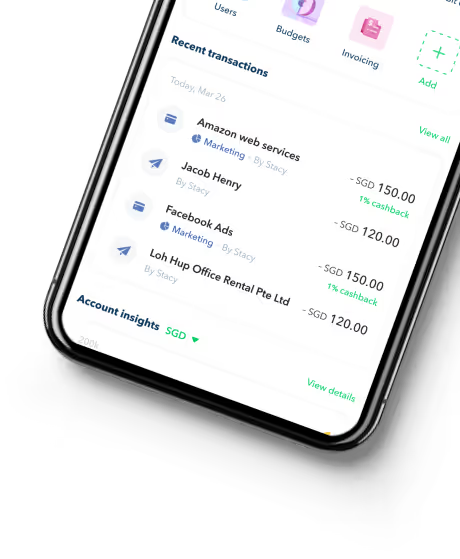

Save on FX fees and earn unlimited 1% cashback on qualified digital marketing and SaaS spend

Eliminate the need for time-consuming out-of-pocket reimbursements.

Improve your cash flow with a credit limit to manage everyday expenses (available to eligible businesses)

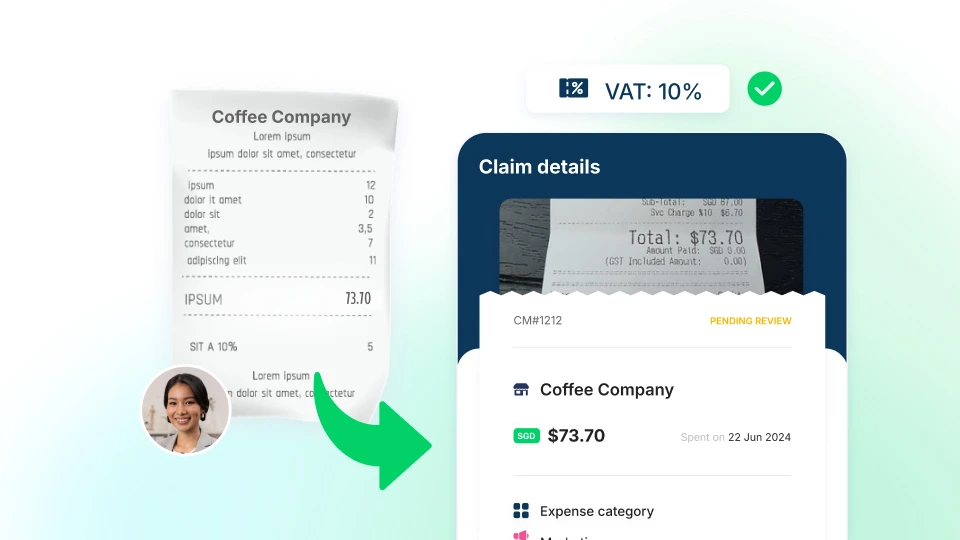

Make claims painless for the entire team

Submit, review, approve, and disburse claims from one dashboard

Employees can submit claims in seconds by scanning receipts via the Aspire app. No more missing receipts

Customise multi-level approval flows based on spend policies for easy reviewing

Pay reimbursements directly from your Aspire account so employees get paid faster

Manage claims alongside other expenses in a centralised platform. No reconciliation required

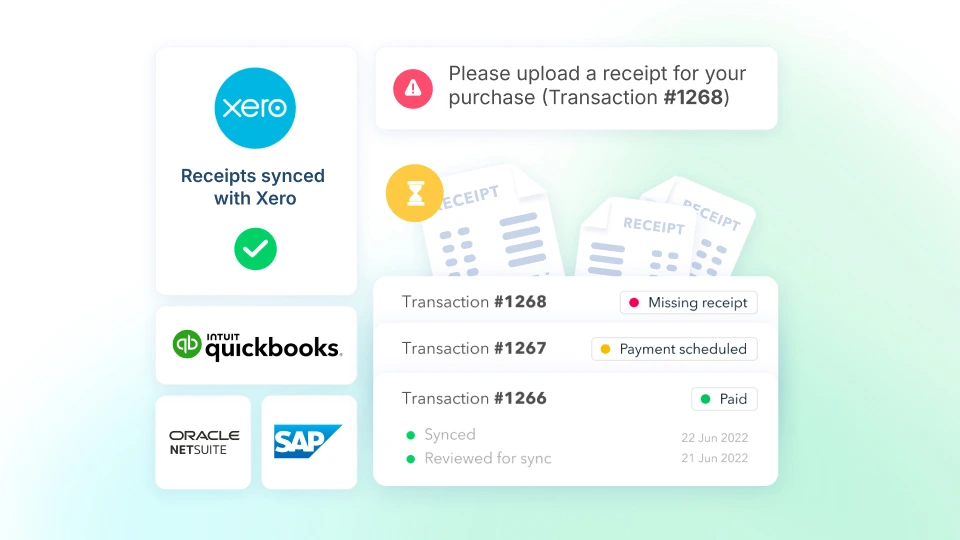

Close your books 2x faster with accounting automations

Reduce manual errors and save hundreds of hours with native integrations and smart data recognition technology

Eliminate missing receipts with automated receipt requests

Sync card payments, employee claims and even photos of uploaded receipts with Xero with the click of a button

Use Aspire as a central document repository to store all company expenses and supporting documents

Hear it first from our customers

Gregory Van

CEO of Endowus

Holly Qian

Head of Finance, First Page Digital

William Chong

Finance Director at Glints

FAQs about Aspire expense management

How to sync expenses in NetSuite?

What is the Sync Expenses feature for NetSuite?

The Sync expense for NetSuite is a feature that allows you to sync any money-out transaction directly from Aspire to NetSuite. You will be able to create Spend money transactions on NetSuite, under the "Bank" > "Cheques module", including all expense details and attachments.

All you have to now do is reconcile the expense on NetSuite!

Who can use the Sync expenses feature with NetSuite?

Any user who has access to the accounting features, i.e. Admins and Finance users can access the Sync expenses feature. However, to set up the connection with NetSuite, you will need an Admin account on NetSuite.

What are the fields that will be synced with NetSuite, when using Sync expenses?

You will be able to review and fill all the fields that you need to create a Spend Money transaction on NetSuite, including the NetSuite expense account, Tax rate, and NetSuite standard classifications, directly from Aspire before you sync a transaction. All values along with the receipts attached to the transaction will be synced with NetSuite.

Will custom fields also sync from Aspire to NetSuite?

Currently, only Standard Fields and Classifications (Department, Location and Class) will be synced between Aspire and NetSuite. In case you have custom fields enabled on your NetSuite account, please make sure to make them non-mandatory or set a default value for the custom fields, before syncing your data from Aspire to NetSuite.

For step by step process on how to go about this, read here

How to sync expenses with Xero?

What is the Sync Expense feature for Xero?

The Sync expense for Xero is a feature that allows you to sync any expense directly from Aspire to Xero. You will be able to create Spend money transactions on Xero, including all expense details and attachments.All you have to now do is reconcile the expense on Xero!

Who can use the Sync expenses feature with Xero?

Any user who has access to the accounting features, i.e Admins and Finance users can access the Sync expenses feature

What are the fields that will be synced with Xero, when using Sync expenses?

You will be able to review and fill all the fields that you need to create a Spend Money transaction on Xero, including the Xero account, Tax rate, and Xero tracking categories, directly from Aspire before you sync a transaction. All values along with the receipts attached to the transaction will be synced with XeroFor step by step process on how to go about this, read here

How to integrate Aspire Account with Zoho Expense?

By using the Export Data feature in your Aspire account, you can seamlessly integrate your Aspire data with Zoho Expense for efficient reconciliation, data tracking and auditing, and reporting.

The Export Data feature allows you to export expenses (money out) data. Follow the steps by steps below to learn more:

- Navigate to "Export Data" on Aspire and select "Money out"

- Select the relevant filters in case you want to filter the data for your export, and then select the "Zoho expenses" to export your statement

- Open Zoho

- Click the Expenses module on the left sidebar.

- Click the hamburger icon (next to the gear icon) on the top right corner and select Import Expenses

- Choose the file that needs to be imported. This file can be in TSV/CSV/XLS format

- Match the fields in Zoho Invoice with the fields in your file and hit the Next button

- If all the fields match perfectly, the system would show a message saying the same, after which you can click the Import button to finish the process

- In case there is any mismatch, the system will notify you with a message. You can go back and match the file, or you can make changes in the file and import it again.

FAQs about expense management

What is expense management?

Expense management is the comprehensive process of tracking, controlling, approving, and analysing an organisation's spending to ensure it aligns with company policies, improves financial efficiency, and identifies opportunities for cost savings. It involves establishing expense policies, utilising automated software for expense reporting and reimbursement, and regularly analysing spending data to make informed financial decisions and boost business agility.

Why is expense management important for businesses?

- Cost control - It improves visibility and oversight of company-wide spending to eliminate inefficiencies and reduce waste.

- Financial accuracy - It ensures precise and compliant financial records for tax, audit, and reporting purposes.

- Policy enforcement - It promotes consistent adherence to internal expense rules and external regulatory requirements.

- Operational efficiency - Expense management reduces manual work and errors through automation, improving productivity across finance and HR teams.

- Strategic decision-making - Delivers actionable insights into spending behaviour to support better financial planning and resource allocation.

- Employee satisfaction - Simplifies the reimbursement process, ensuring faster payouts and a more positive employee experience.

What are the key components of expense management?

- Policy Creation - Defining clear expense policies, including allowable spend categories, limits, and approval hierarchies.

- Expense Tracking - Capturing business expenses in real time using corporate cards, expense management software, or integrated platforms.

- Approval Workflows - Streamlining the submission, review, and approval of expense claims to ensure accuracy and compliance.

- Reimbursement Management - Facilitating timely and transparent reimbursement for out-of-pocket expenses through automated systems.

- Data Analysis & Reporting - Using analytics to identify spending trends, reduce unnecessary costs, and inform budgeting decisions.

- Integration with Financial Systems - Connecting expense tools with accounting or ERP platforms for seamless reconciliation and reporting.

.webp)

.webp)

.png)