Summary

You might be familiar or probably already using Xero for all your business accounting needs. Whether you’re a small business owner or an accountant, Xero users can benefit from their comprehensive range of integrated features which include payroll, paying bills, claiming expenses, tracking projects, and even bank reconciliations.

But did you know that Aspire became Xero’s first business neobank partner in Southeast Asia? Through this partnership, users will be able to reduce manual data entry by automatically importing Aspire transactions into Xero every hour, giving business owners a clear picture of their company’s financial position.

If you’re a Xero customer and have not tried Aspire, here’s 3 reasons why you should:

1. It’s Easy — Better than a bank account, available anytime

With Aspire’s business account, money management has never been simpler. Users can set up their digital account online in just a matter of minutes, which finally makes waiting in line at the bank a thing of the past.

Aspire provides users with in-depth account insights on how you are managing your finances along with an incredibly simple user interface that anyone and everyone can understand. Not only are our services available on desktop but it can also be accessed on mobile, making business banking convenient and accessible for go-getters like you.

2. It’s Fast — Save time with smart features & integrations

Our smart integrations like the multi-user access feature enables you and your team to manage company expenses through card budgeting, where directors can grant co-founders and/or accountants access to the account. This eliminates the need to go through various key personnel to retrieve account records and gives your team a sense of ownership at the same time.

What’s more is that Aspire has one of the fastest data syncs in the market through our Xero integration, allowing you to always be on top of money matters wherever you are. Apart from that, auto-spend categorisation, scheduled and bulk payments, and all of your expense management needs will be taken care of all in one business account as well.

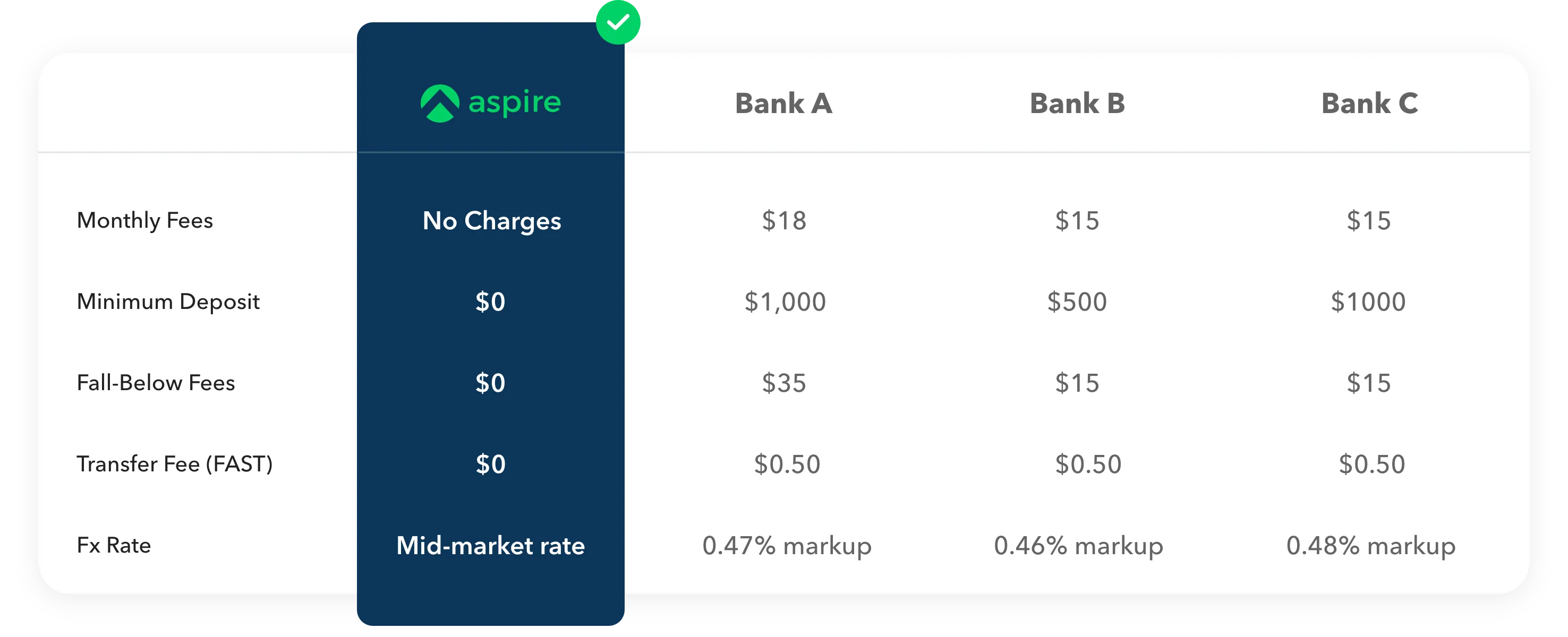

3. It’s Transparent — No frills, no hidden fees

No monthly, hidden, or fall-below fees—that’s as transparent as it gets. Our approach to pricing ensures that users know exactly what they’re paying for upfront rather than only after the transaction has been made. We know that transparency doesn’t stop at disclosure, which is why we break it all down for you so you don’t have to.

On top of all that, Aspire users can also earn 1% Cashback on your digital card spend for all major performance marketing and SaaS services. We have partnered with industry giants such as Google Suites, Amazon Web Services, Shopify, Slack, Typeform, and more to better connect you with the services you already use and save more on what you already pay for.

Bonus: it’s absolutely free-of-charge. If you’ve ever wondered what it’s like to have a virtual business debit card, now is the time to give it a try.

Through Aspire’s direct integration with Xero, managing business finances has not only become easier but also fun. For existing Aspire users who want to connect their account to Xero, click here to find out how.

If you have yet to open an account with Aspire, we have good news for you. New members can get 50% off the first 3 months of your Xero subscription and enjoy smart features from hourly data syncs to auto-spend categorisation. Users can finally enjoy a seamless and hassle-free experience with the fastest accounting integration in the market. All you have to do is sign up as an Aspire member and open the reward banner on your Aspire dashboard to claim your reward. It’s as simple as that!

Open an Account in 5 Minutes

No matter where you are in the world, you can open an account with us today in just five minutes. Aspire business account holders can make transactions in more than 40 currencies at real exchange rates and have a seamless banking experience for you and your business.

Sign up in 5 minutes, today!

.webp)

%201.webp)

.webp)