Summary

You only get one shot at closing the perfect Series A deal. It’s the culmination of many months of hard work. So how do you get the best series A deal terms?

In this article, you'll discover:

- Crucial points when negotiating Series A term sheets.

- What to keep in mind when evaluating your Series A deal terms.

- How to negotiate with an investor.

Preparing for a Series A closing

Series A funding introduces three new concepts in the final negotiation stages:

- Due diligence

- Term sheets

- Business valuation

1. Due diligence

Venture capitalists scrutinise your numbers and business metrics to validate their investment opportunities. This can happen before or after participating in partner meetings, but it concludes before you, and your investors agree to terms and close the deal.

What to expect and how to prepare for due diligence

Prepare a structured folder of your business documents ordered with headings and a detailed index.

What to include:

- Corporate records

- Detailed information on your business plan and financial statements

- Intellectual property (IP) rights

- Security issuances and agreements concerning securities

- Material agreements

- Any information about ongoing or pending legal disputes

- Information about employees and employee benefits

See Y Combinator’s complete due diligence checklist for Series A funding.

2. Term sheets

What is an investor term sheet?

An investor term sheet summarises investment deal terms. It’s a non-binding document that serves as a basis for more detailed, legally binding records (also known as the stock purchase agreement).

Investors issue a term sheet as a statement of interest to invest in your start-up.

Negotiating a venture capital term sheet

You won't have much time to negotiate the details of a term sheet. After receiving a term sheet from an investor, you'll be asked to decide within 24-48 hours.

However, it’s possible to ask for an extension by saying you need more time to discuss with your professional advisors and co-founders. Remember to communicate how much extra time you need and stick to that commitment.

All term sheets come with 30-45-day exclusivity clauses, which prevent you from approaching other investors after signing. Your only moment to get competing offers from other investors is after you get the term sheet but before you sign it.

What terms should I discuss on my venture capital term sheet?

The most important terms to discuss are your economic and control rights.

Economic rights

You’re about to exchange shares for funding. But what impact does it have on future financial decisions?

After a successful exit, how will you distribute the money amongst founders, team members, and investors?

Examples of economic terms:

- Business valuation: An estimate of how the story and product of your start-up translate into dollars. It determines how much investors get for their investment and how big a share start-up founders give up during fundraising.

- Liquidation preferences: How much an investor receives if your start-up company is closed and its assets turn into cash. The preferential amount is either equal to the investment amount or a multiple of it. Investors usually take priority over ordinary shareholders.

- Anti-dilution rights: Rights protecting the value of a current investor's shares when your company raises money at a lower valuation than a previous funding round. (This is called a 'down round’).

- Share vesting: Vesting means an investor or co-founder is rewarded with shares or stock options over time. They only receive the full rights to their allocated shares over a certain period or after reaching a milestone. Vesting incentivises founders to stick around for a period. A typical vesting period for Southeast Asia start-ups is approximately 3-4 years.

Control rights

The second part of the term sheet negotiation determines how much control investors will get.

Who has majority control of the company? How is the company board of directors structured? Is there an even split between the founder and investor-friendly parties?

Examples:

- Board composition: Your board set-up influences crucial company decisions. Appointed investors (usually your lead investor) will want board representation. Founders need to be careful not to give up their company control (meaning they can't decide without investor consent).

- Investor veto rights: Investors will want veto rights over specific company actions like acquisitions or decisions around share allocations. This means you need investor approval for these decisions.

Negotiate the scope of veto rights, especially those that influence the company's ability to raise future funding rounds, plan budgets, expand in other markets or hire critical people.

Think about streamlining the consent process, so it doesn't significantly affect your company's control.

Frequently asked questions about investor term sheets

What if I’m speaking to other funds when I get a term sheet from an interested investor?

When multiple investors show interest, you get to choose which investor is the better fit for you. But you need to deal with the situation carefully and responsibly.

Here’s how:

1. Inform other funds that you have a term sheet: Keep the firms that offered you the term sheet confidential, as investors will talk to each other.

2. Read and understand the offers to compare terms: Take the time to understand standard market terms, especially financing and employment terms. When in doubt, consult a professional expert for advice.

3. Ensure every term in your investor term sheet is crystal-clear and documented: Every point you make or negotiate must be written explicitly in the legal agreement. In your Series A funding, terms you agree on can follow you into future fundraising efforts. Take the time to get them right the first time.

4. Know what’s essential to you: Terms like board control, vesting of founder’s shares, or investor veto rights should be evident in the term sheet. Make sure all the terms which may directly affect you also end up in the term sheet.

What should I do when starting a board of directors?

Think long-term when selecting board members. You'll want to look at people who are passionate about the company and want to see it grow. First, hire a lawyer specialising in board set-up. Then, outline a role for each board member. Define the goal of each position and how they play a part in the company's strategic decisions.

3. Business valuation

Business valuation is the process of estimating how the story and product of your start-up translate into dollars. Determining your start-up valuation is part of discussing Series A deal terms.

The valuation process analyses your business on operational and strategic levels to create assumptions for your future earnings and growth rates. Some investors may ask you for a valuation when you’re fundraising.

How do I set a valuation for my start-up?

There are multiple models to set a valuation for your start-up. These two are the most common:

1. The market multiple method: Look at companies in your industry to determine their valuation compared to their actual revenue. These are called multiple numbers. Multiply your revenue by this number to get your valuation.

Venture capital investors like this method as it strongly indicates that the market is willing to pay for a company like yours.

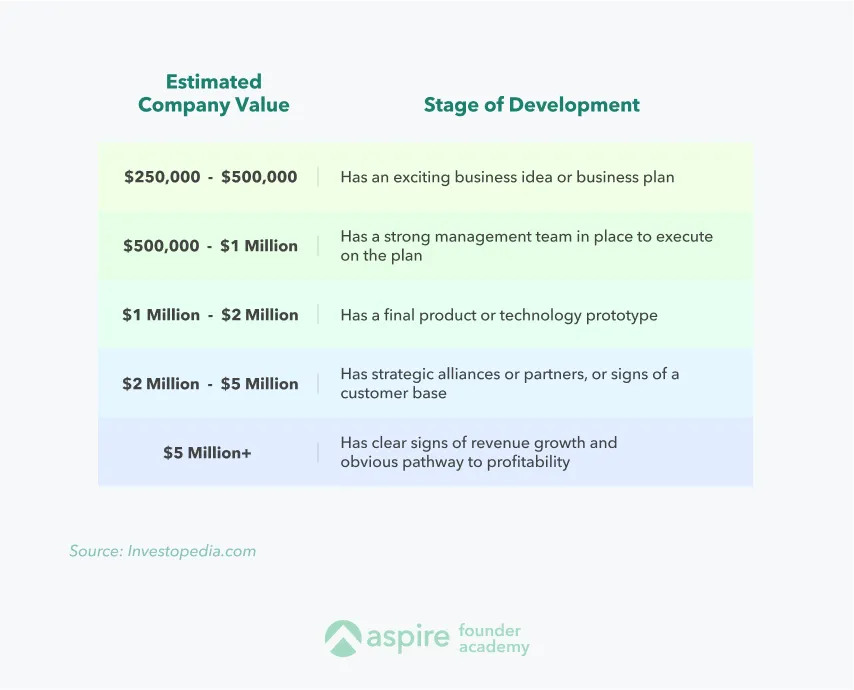

2. Valuation by stage method: Analyse the milestones you’ve attained and the maturity of your company to reach an estimated valuation. The more mature your company, the higher its value.

Series A deal structures

The most common deal structure is the venture capital model, where founders exchange a piece of their company for funds. But there are other deal structures for companies in the Series A stage.

- Venture debt: Similar to a loan, but you make regular payments to an investor instead of a bank to fulfil the loan. This works best if you need a capital boost to increase growth over a short period (12-24 months) and you don’t have sufficient assets to use as collateral.

- Asset-based financing: This method is also like taking a loan, but you put up company assets as collateral. Similar to a mortgage.

- Revenue-based financing: This model is for companies that can show a positive return on investment for their marketing spend. Amounts repaid are a set percentage of your monthly revenue.

Frequently asked questions about start-up valuation

What if I’m not sure about my valuation?

If you’re unsure and investors ask you for a number, you better wait for them to offer.

However, you want to work with your advisors and team to set a theoretical valuation range. Rely on investor meetings and comparisons with other companies in your industry to help you get the correct range.

You could also work with a third-party valuation to help you determine a fair value for your company.

Is a high start-up valuation always better?

Not necessarily. In Southeast Asia, a high valuation comes with its risks. High valuations increase expectations for future funding rounds. They can even put off investors as it can signal that you are unrealistic or challenging to deal with in future rounds or during a company exit.

Furthermore, you leave yourself with little room for error. Your investor might resent you if things don't go according to plan.

How to negotiate with an investor: Six negotiation tips for Series A deal terms

After the due diligence and valuation stage, you’re moving into the final phase: Closing Series A funding. Follow these best practices for a successful term sheet negotiation and future cooperation.

1. Know which deal terms are important to you

Take some time to think and discuss with your team. What are you looking to get out of these negotiations and potential investor relationships?

How much equity are you willing to give up for this funding round? Is it critical for you and your team to maintain majority control of the company?

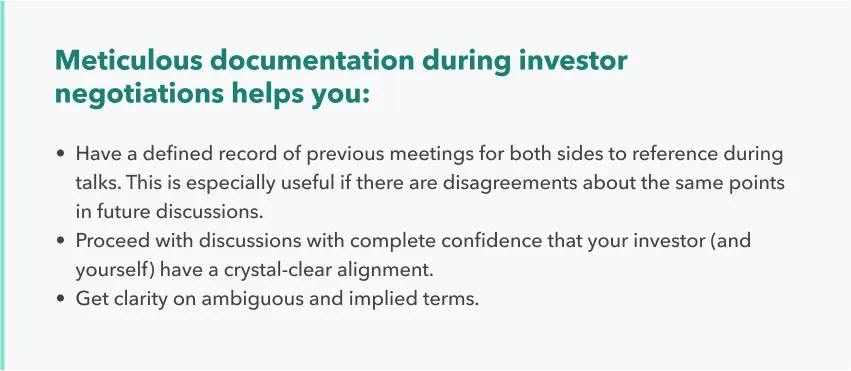

2. Document everything discussed during meetings

You may agree to change terms or include variations in your finalised document during your negotiation processes. Remember to document it! If you decide to change something, send an email to the investor confirming what was discussed and agreed on during the meeting.

It’s best to do this immediately afterwards while your memories are fresh. You can approach this email in three simple steps:

1. Thank the investor for the meeting.

2. Summarise the main points of discussion and what was agreed.

3. Ask the investor to confirm and acknowledge discussion points and next action steps.

3. View your investor as your business partner and discuss their involvement in your company

Remember, your investor is your business partner, not just the person who gives you money.

Avoid focusing only on funding and equity topics during your discussions. Instead, talk about what you expect your investor to bring to the table beside their funding commitments.

Are you expecting access to your investor’s professional network and regular strategic advice? Are you looking to build your list of investors for future funding rounds or hire key team members? Remember to make these expectations clear during your Series A negotiations.

It’s in the investor’s interest to add value to your company and guide you to a successful exit so they can gain on their investment. Think beyond meeting your immediate funding requirements. Look at what can help you create more value strategically in the long run. Then work with your investors to achieve these goals.

4. Focus your negotiation on outcomes versus specific terms

Focusing on outcomes instead of specific terms ensures you're on a level playing field with the investor. It's easier to get what you're looking for without the jargon.

Focusing on outcomes helps you figure out what exactly an investor is asking for.

Let’s say you want to negotiate founder-majority control of your board. Instead of focusing on the specific number of founders and investors on the board, focus on outcomes.

Here’s what an outcome-focused ask may look like.

“The start-up founders need to maintain board control. Can we agree on that as an outcome and have our lawyers work out specific details in the term sheet?”

Keeping your discussions focused on outcomes instead of specific mechanics ensures a more productive debate for you and your investor.

5. Don’t be afraid to ask clarifying questions

Negotiations are a high-pressure situation, and sometimes, you might not be sure of what you're being asked.

How to handle ambiguous situations:

- Ask your investor what these terms mean for you and your company regarding company control and economics.

- Ask for time to discuss with your co-founders or professional advisors.

6. Commit to what you’ve agreed on in negotiations

Once you've negotiated a term and are fully aware of what you've agreed to, make sure to stick to it. Negotiations with external investors rely on trust. Breaking an agreement damages your relationship with your investor and your reputation within VC circles.

Untrustworthy behaviour after commitment can also result in deals being called off.

Follow our step-by-step guide to negotiate successfully with your Series A investor

You've put in much work to get to this point in your start-up fundraising journey.

If you've selected your investor well, have a solid story to tell and have the results to prove it, remember good investors are not your enemies.

%201.webp)

.webp)