Summary

When you run a business, there are different kinds of costs that you incur. It doesn't matter if you are a startup or a large corporation; you need to spend on certain things to ensure you can produce goods or render services. These expenses can be fixed expenses, variable expenses, operating expenses, overhead costs, advertising and marketing expenses, and capital expenses, among others.

In this article, we will explore what are overhead costs and understand them better with real-life overhead cost examples.

What Is Overhead Cost? Understanding Overhead Meaning

Overhead cost, also known simply as overhead or overhead expenses, refers to all those expenses in a business that cannot be linked to the production of a product or rendering of a service.

Essentially, overhead cost meaning is all those expenses that a business incurs to stay in business, whether or not it makes a profit. When understanding what is an overhead cost, you can think of them as indirect expenses.

Understanding What is Overhead in Detail

Overhead costs refer to indirect material costs, cost of indirect labour, and other indirect expenses that are incurred in the regular day-to-day operation of a business but cannot be charged directly to any specific product or service you produce. They must be shared among all cost units.

You will need to pay overhead on an ongoing basis. It doesn't matter how much your company sells. For example, as a service-based business, you may have an office with overhead costs such as rent, utility and insurance. These have to be paid whether or not you make any sales in a month. Since they are not directly linked to the business's expenses, they will count as overheads.

Now that we have defined overheads let's understand how an overhead cost is accounted for. Overhead expenses appear on a company's income statement. They directly affect the profitability of your business. They have an impact on your net income. They are apportioned across all the goods and services you produce and are reduced from the sales to arrive at net income.

Types of Overhead Cost

To understand what is overhead better, let's categorize them into different types of overhead costs.

Fixed Overhead

Fixed overhead is a cost that remains the same for a period of time. It does not change with a change in business activities. Irrespective of the business phase - whether you are starting out, growing or peaking - fixed overhead remains the same. Some fixed overhead cost examples are rent, depreciation, insurance and cost of licenses.

Variable Overhead

Variable overheads fluctuate with the level of business activity. Even though these are not related directly to the production of goods or services, variable overhead costs vary depending on the volume of your goods or services. A variable overhead cost example is shipping and mailing costs. It goes up with the number of goods that you sell.

Semi-Variable Overhead

Semi-variable overhead can be defined as a combination of fixed and variable overheads where the overhead cost remains static up to a period of production but then increases with volume. For instance, commissions paid may remain the same up to 1,000 units but might go up for every 500 units after that. In this case, commissions will be considered a semi-variable overhead.

Others

Overheads that cannot be classified into any of the above categories will come under this head. They may also vary depending on the nature of the business. For instance, for a multinational company, general and administrative overheads will apply. This will include costs related to general management, such as the cost incurred for human resources, receptionists, accountants, etc. Sales overheads will include expenses incurred for marketing and sales of a product. Some other examples are research overhead, maintenance overhead, manufacturing overhead, transportation overhead, etc.

Overhead Cost Examples

You should now know overhead meaning, what are overhead costs and the different types of overhead expenses. Let's now get into overhead cost examples.

Rent

Rent is the most common overhead cost. Rent is an expense that you pay for utilizing a property for business purposes. Rent may have to be paid monthly, quarterly, annually or as a one-time lease payment. No matter how it is paid, it will have to be charged to the books of accounts every month.

Administrative Expenses

You will incur administrative expenses as a business to support general operations. Since they are not directly linked to any particular business production or service, they count as overheads. Examples of administrative costs may include audit fees, legal fees, employee salaries, and entertainment costs. If you want to reduce this overhead cost, you can consider hiring part-time employees, eliminating entertainment costs or reducing office supply purchases.

Utilities

Utilities are another example of overheads, including the basic expenses you will incur to support main business functions. Examples of utilities include water, gas, electricity, internet, sewer, and phone services.

Insurance

You will have to spend insurance as a business to protect yourself from financial loss. The types of insurance will vary. For instance, you could buy property insurance if you own property to protect yourself from flood, fire or theft risks. You could also purchase equipment, professional liability, or disability insurance for your employees.

Sales and Marketing

Sales and marketing overheads are costs incurred to help increase the sale of your products. They do not impact the production of goods or services in any way. That is why they are categorized as overhead expenses.

Employee Perks

Many businesses provide their employees with perks such as free coffee and snacks, breakfast, gym memberships, yearly trips, etc. These do not have a direct impact on the business's performance. These expenses are considered overhead expenses.

Why is Overhead Cost Important?

Understanding what is overhead and allocating it correctly is extremely important for a business. Overhead costs directly impact your business's income statement and balance sheet. Therefore, you must define overheads clearly and keep track of them to ensure that your final bottom line recorded is accurate.

Apart from accounting requirements, allocating overhead is essential because it helps you make business decisions, especially related to pricing. Using just direct costs to determine pricing could eat into your profit. No matter how much you produce or sell, you will incur over costs. By incorporating overhead costs into pricing, you can ensure that you are able to make profit. Understanding what is overhead and allocating it correctly can also help you manage your costs better.

How to Calculate Overhead Cost?

To calculate overhead cost or overhead expenses, you first need to understand what are the overhead costs that you incur. You then need to categorize each of them for a specific time period, usually by allocating them per month. All indirect costs are overhead expenses. However, you need to be careful while allocating these because it may change according to the nature of your business.

For instance, most businesses will consider legal expenses as overhead costs. However, if you are a law firm, legal costs are a direct business expense that impact your services. Hence, they will not be indirect expenses.

After you have categorized the expenses, you must add all the overhead costs for the accounting period to arrive at the total overhead cost.

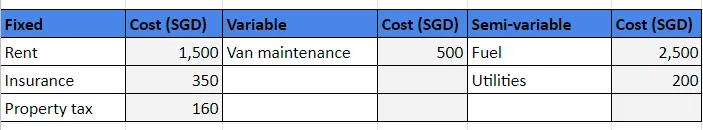

For instance, let's assume that you incur the following expenses for the month of November:

- Rent: SGD 1,500

- Insurance: SGD 350

- Property tax: SGD 160

- Fuel: SGD 2,500

- Van maintenance: SGD 500

- Utilities: SGD 200

Your company has a total overhead cost of SGD 5,210 in November.

Let's break this down.

You can also calculate overhead rate as a percentage of sales. This tells you how much your overhead is compared to your sales and how you can reduce this expense for better efficiency of business.

Overhead rate = Overhead costs/ Total Sales

Let's assume that your company has a total sales of SGD 7,600 for the month.

Overhead rate = 5120/ 7600 = 0.6855 or 68.55%

This means that for every dollar earned in sales, you spent SGD 0.69 in overhead expenses.

With this information, you can now work on reducing your overhead expenses. For instance, you could choose to hunt for an insurance provider who is cheaper. Also, if fuel prices reduce over time, that portion of the semi-variable expense will reduce.

How to Allocate Overhead Costs?

To allocate overhead expenses, you first need to compile all relevant costs. The next step is to identify a cost driver so that you can allocate the costs accordingly. For example:

- Rent for the period is SGD 1,500.

- Let's assume that rent is allocated according to the number of finished goods produced. If you produce 100 goods, then the rent overhead will come up to SGD 15 (or SGD 1,500/100) for the cost of each good.

- We arrived at this number by dividing the rent expense by the cost driver quantity to find the allocation per unit.

You must complete a journal entry to move the costs from overhead, which is a general asset pool, to finished goods, which is a more specific asset account.

You can also allocate overhead expenses based on other cost drivers such as hours worked, machine hours, activity-based drivers, etc.

Final Word

Understanding what are overhead costs through overhead cost examples and to clearly define overhead is vital to your business as it gives you power over your profit. Once you have allocated overhead costs for a period, you can calculate overhead rate and determine how it contributes to your overall expenses. You can then work on reducing your overheads and also plan your overhead cost for the future.

%201.webp)

.webp)