Summary

If you are looking to expand your business in the future, having a separate account for your business helps to establish credibility among prospective stakeholders and investors. But with countless options available in the market today, how do you go about making such a crucial business decision?

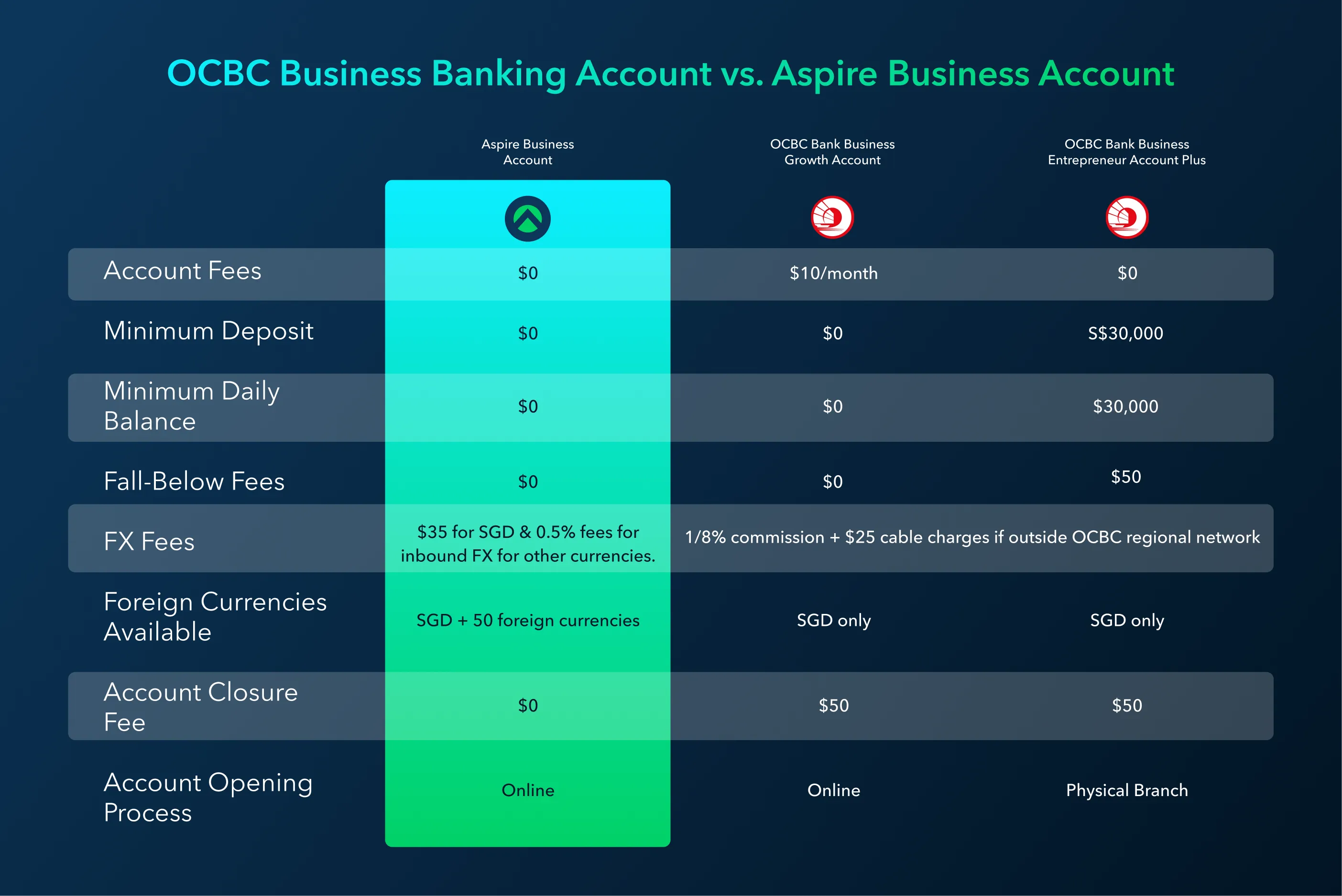

Today, we’ll be exploring the the differences and similarities between OCBC business banking accounts and Aspire Business Account.

What are the different OCBC Business Banking Accounts Available?

As Singapore’s longest established bank, OCBC has a long history of providing comprehensive banking solutions for customers in the country and across the region. While they have several bank accounts catering to different demographics and needs, some of their best business bank accounts are the:

- OCBC Business Growth Account

- OCBC Business Entrepreneur Account Plus

The similarities: OCBC Business Banking Account vs. Aspire Business Account

- Account application process: Both accounts allow its users to apply online for free, with no physical branch visits

- Minimal documentation: Customers no longer have to prepare hefty verifying documents in order to open an account

- Costs and fees: Both don’t require an initial deposit or minimum balance and have zero fall-below fees, making it ideal for startups and small businesses

The differences: OCBC Business Banking Account vs. Aspire Business Account

- Physical presence: Just like most established banks in Singapore, OCBC still has several locations for customers to visit; Aspire operates entirely online as a payment service provider with no physical branches

- Number of mobile apps: OCBC has multiple mobile apps for multiple functions like the SG Mobile Banking app, Pay Anyone app, and Business Mobile Banking app, which can be confusing for customers; Aspire has one mobile app where multiple functions can be performed in a single platform

- Cashback rewards for customers: OCBC business banking users are only entitled to cash rebates on local and foreign currency spend, while Aspire users can receive cashback on qualified marketing and SaaS spend

To help you make an informed decision for your business, here’s a visual comparison of all three accounts side by side:

Now, let’s take a closer look at the business accounts offered by OCBC Bank and what’s in it for you.

1. OCBC Business Growth Account

If you own a small business or startup that’s still in its early stages, OCBC’s Business Growth Account is an ideal option for you. With a low monthly maintenance fee, no minimum deposits or balances, and no fall-below fees, this remains one of the most popular business accounts in the country for aspiring business owners who are looking to make significant cost savings.

Besides the business banking benefits available like unlimited FAST and GIRO transactions, users can also save time and boost productivity with their complementary business tools such as their business dashboard and seamless online banking through the OCBC Velocity app.

How to open an OCBC Business Growth Account:

- Fill up the application form on the OCBC website or visit their branch.

- The bank account opening application can be done digitally, and afterwards, a physical visit to the bank may be requested for.

- Upon successful application, your OCBC Business Growth Account will be opened instantly.

How to close an OCBC Business Growth Account:

- If you wish to close your account, applicants have the option to complete the corporate account closure form at the branch, or downloading the form and mailing it back to the branch.

- The OCBC customer representative will get in touch with you in the next few days to notify you of the successful account closure.

6 things you need to know about the OCBC Business Growth Account

- Minimum balance fee: No minimum balance required

- Account fees: $10 per month (Waived for the first 2 months)

- FX fees: 1/8% commission + $25 cable charges if outside OCBC regional network

- No initial deposit

- Complimentary digital business dashboard

- No fall-below fees

2. OCBC Business Entrepreneur Account Plus

Unlike the Business Growth Account, the OCBC Business Entrepreneur Account Plus is more suited for bigger and more established businesses. With a larger minimum deposit and daily balance of S$30,000, this requires companies to have a consistent and significant cash flow to maintain these amounts.

While all registered business in Singapore is eligible to apply, this account is meant to support companies that are working towards expansion—either locally or internationally. With that in mind, we advise new businesses and startups to consider the initial and long-term costs of maintaining an OCBC Business Entrepreneur Account Plus Account before committing.

How to open an OCBC Business Entrepreneur Account Plus:

- Fill up the application form on the OCBC website.

- Upon completion, an OCBC customer representative will get in touch with you to arrange an appointment at a local bank branch.

- After the appointment, the OCBC team will then handle your application manually and notify you if your application was deemed successful.

How to close an OCBC Business Entrepreneur Account Plus:

- Similar to the account closure for the OCBC Business Growth Account, applicants have the option to complete the corporate account closure form at the branch, or downloading the form and mailing it back to the branch.

- The OCBC customer representative will get in touch with you in the next few days to notify you of the successful account closure.

6 things you need to know about the OCBC Business Entrepreneur Account Plus

- Minimum balance fee: $30,000

- Account fees: No account fees

- FX fees: 1/8% commission + $25 cable charges if outside OCBC regional network

- Complimentary digital business dashboard

How does the Aspire Business Account compare?

Although the Aspire Business Account is a much newer entrant compared to such an established local bank in Singapore, it also has plenty to offer to its users.

.webp)

With Aspire, you can say goodbye to long waits, answering machines, and physical branch visits. As a fully digital payment service provider, an Aspire Business Account can be opened and managed entirely online with just a click of a button. From competitive fees, automated insights, multiple integrations, and round-the-clock customer support, customers are in for a seamless finance experience.

6 things you need to know about the Aspire Business Account:

- Minimum balance fee: $0

- Account fees: $0

- Local transaction fees: $0

- FX fees: $35 for SGD and 0.5% fees for inbound FX for other currencies

- FX currencies: Send and receive international payments in 50+ currencies with low, transparent fees

- Initial deposit: $0

Made for entrepreneurs, by entrepreneurs

With modern entrepreneurs in mind, we are on a mission to provide the most comprehensive business finance solutions to equip you. Get started on your journey with the #1 digital business account for startups today!

%201.webp)

.webp)