Summary

While businesses and agencies deal with customers and clients on a daily basis, not all maintain robust account management practices, and some businesses have no semblance of account management operations at all. If your agency isn’t consciously and actively managing its accounts yet, it is probably not performing as effectively as it could be. Unsatisfied customers whose needs are not addressed can lead to later customer churn, a leading cause of client loss for many agencies, and lost opportunities to increase revenue.

No organisation wants to leave money on the table. Adopting a strategic account management program can help companies battle churn rates that plague companies across industries.

What is Account Management?

Account management involves building and maintaining relationships with clients, coordinating internal resources to deliver quality work, and driving business growth through a deep understanding of client goals and objectives. Simply put, it is a critical component of agency success, requiring a nuanced understanding of both the client's needs and the agency's capabilities in order to deliver steady revenue or cash flow to your agency. .

At its core, effective account management requires a unique blend of strategic thinking, communication skills, and project management expertise. Most importantly, agencies should focus on delivering consistent value to their clients in innovative ways that build trust and grow business through:

- Offering continued training on the company’s product or service offerings

- Providing on-demand expertise and advice

- Delivering exceptional customer service

- Creating consistent value-adds to existing product or service offerings, such as after-sales care and warranties.

Why is Effective Account Management Important?

For most organisations, the oft said business adage rings true: 80% of your sales revenue comes from 20% of your clients. It would make sense, then, to treat these valuable assets with greater care. However, too often, companies don’t have a dedicated process to nurture those key business relationships. All too often, this leads to a loss of cash-flow, and agencies will be forced to expend precious liquidity to either regain these lost clients, or onboard new ones.

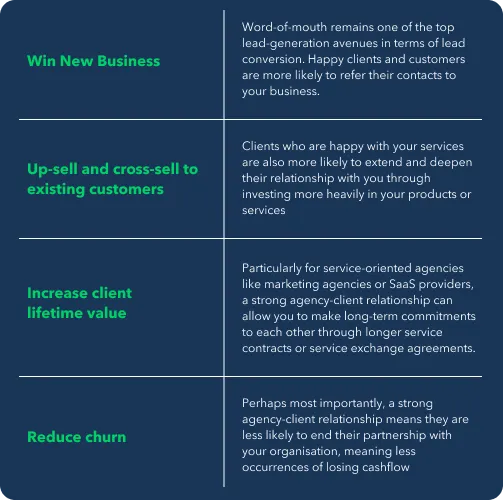

The work isn’t done when the sale closes. Customers big and small leave for many reasons, and one of the best ways to avoid a negative impact to your financial bottom line is to implement a strategic account management program. Along with keeping your clients happy with your services, a strong agency-client relationship can help you:

The Entire process is usually the responsibility of dedicated account managers, who, along with strong customer-service skills, should also be adept at handling multiple simultaneous accounts.

The Account Manager Role

The best account managers are those who can balance the demands of the client with the realities of agency operations. Whether you run an advertising, marketing or SaaS agency, hiring experienced account executives who understand a client’s needs, and are able to proactively reach out in critical situations will increase your long term revenue pipeline.

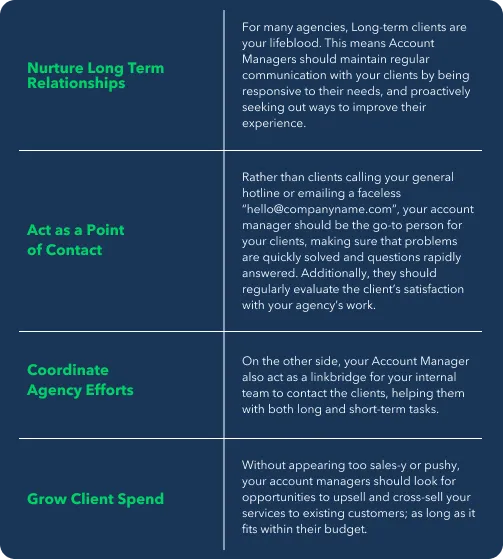

As a rule of thumb, account managers should:

When reviewing the duties required of an account manager, it becomes clear that they need to wear many hats; from being a communicator, to project manager, to sales representative.

Common Challenges in Account Management

Strategic Account Management has always been a delicate act. The AM team is constantly caught between keeping their C-suite happy, ensuring clients in their portfolio pay their agency fees in a timely manner, and ensure they are satisfied with both their work and the service offered by the agency.

While building and nurturing customer relationships, you are likely to face certain challenges:

- Thinking like a vendor - Stop thinking like one. Vendors are easy to replace, and your customer can always find someone faster, better, or more importantly, cheaper than your agency. Instead, build real engagement with your clients to help them achieve their goals by positioning yourself as a strategic business partner, one that can help them achieve their own business goals.

- Relying too much on “gut” Instinct - Gone are the days where sales and operations were done based on instinct. They do work, but key account management processes and consistent workflows are essential, especially when the time comes for you to scale and standardise your approach across more clients.

- Being Reactive - Account Managers may get busy dealing with operational matters, or fighting fires on a regular basis and miss talking strategy with their clients. If they behave in a reactive manner, they run the risk of missing value-adding opportunities for their clients.

- Limited Resources - Smaller agencies or smaller AM teams will find it challenging to actively engage all their clients, and may struggle to differentiate or prioritise high-value clients from their overall customer base.

A common theme surrounding these challenges comes down to time requirements - all too often, AMs are asked to do more with less.

Account Management Best Practices

With the right framework and account management model, you can elevate your client management services and improve customer retention, creating deeper business relationships and accomplishing client goals. To do so, here are some best practices you should follow.

Embrace Clarity in Roles

Clearly demarcate the lines between customer success, account management and sales. Ensure that all members of your after-sales care team are aware of their roles and responsibilities. This is especially important if you have multiple account managers, project managers, and sales reps. You need to make sure that everyone knows who is responsible for what, so that there are no overlaps in responsibility.

Making these roles and boundaries clear from the outset will help ensure that your team is working effectively and efficiently—which is exactly what you need to deliver great results.

Break down communication silos

With so many moving parts, it's easy for information to get lost in shuffling teams and colleagues. When information isn’t shared between team members, it can lead to big problems down the line. To tackle this, break down communication silos within your agency by encouraging team members to share information with one another. That way, everyone is on the same page and no one will waste time tracking down already-shared information.

Improve Cross-functional collaboration

Particularly in smaller agencies, the same team often handles both sales and account management responsibilities. However, larger enterprises have dedicated teams for account management. Regardless of team size, whoever holds Account Management responsibilities will need to engage with other departments to ensure they are delivering quality service to their clients. Whether it’s by reaching out to the sales representative who closed the deal to enquire on what was promised, or to the product/operations team to answer a question the client had, cross-functional collaboration is key.

Focus on Account Metrics.

What is your agency’s measure of success? Rather than relying on ‘gut instinct’ to determine client satisfaction, you should focus your attention and make decisions based on customer account information. Monitoring your client metrics will allow you to see their progress, and help you generate future forecasts and actionable insights.

By extension, your organisation should use the same approach to track the AM team’s performance. Tracking account health using established key performance indicators such as customer retention rate and customer satisfaction score will provide you with an unbiased view of your AM team’s performance and help you make decisions on how to scale your AM operations.

Develop Selection Criteria for Key Accounts

Not all clients are created equal. While all provide some value to your agency, some can be elevated to a “key account” status. These strategic accounts should be reserved for customers whose partnerships can propel your organisation towards its goals, and should have dedicated Account Managers to strengthen the relationship between their team and yours.

To determine which accounts are worthy of such status, you should develop a shortlist of selection criteria that will hone in on alignments between your two organisations. Focusing on three to five criteria, weighted in relative importance to your organisation. These criteria should include:

- Product/service fit

- Revenue potential

- Growth potential

- Geographic Alignment

- Solvency

- Existing relationships

- Potential channel partnerships.

Rather than the Account Management Team, senior management should lead this stage, as the selection criteria should be based on your organisation’s high-level strategic goals and vision.

Connecting Account Management with your Finance Function

When it comes to account management, time is always an issue. Account managers should be dedicating the majority of their time to nurturing and deepening the relationship between their organisation and the client. However, many find themselves having to dedicate extensive time and effort tracking finances for each individual project or client they manage, along with managing multiple internal or external campaigns.

To free up your account managers’ time and allow them to dedicate hours to their clients, it's important to ensure they have strong foundational support from your finance team. This is all the more important as both teams should already be aligned on business goals: drive revenue growth and win or keep customers. Too often these teams are not collaborating to achieve these goals because they are working on different systems and not communicating. In a world where customer experience and retention have never been more important, a situation like this could be detrimental to your business.

Aspire all-in-one platform can help solve all these issues by integrating seamlessly with your client management operations, freeing up your time by helping you track and automate project finances and spend limits across hundreds of clients simultaneously. With Aspire, you can allocate and track spending down to a project or client level, providing your AM team a strong, healthy connection with your Finance team moving forward.

With having to spend less time on paperwork, budgeting or tracking, you can spend more time on what’s truly important - your clients.

.png)

%201.webp)

.webp)