Summary

- GIRO (General Interbank Recurring Order) is a secure, MAS-regulated payment method that allows you to automate recurring payments such as payroll, utilities, supplier invoices, and government fees

- GIRO transfers are processed through a three-party system involving your bank, the Billing Organisation (BO), and the Automated Clearing House (ACH), ensuring accurate and regulated fund transfers

- You can use GIRO for direct debit or credit, making it easy to both pay and collect recurring payments with reduced manual effort

- eGIRO simplifies setup by reducing application time from weeks to under 48 hours for businesses, using APIs and real-time bank authentication.

- Key benefits of GIRO include predictable cash flow, reduced administrative burden, and greater payment accuracy, making it ideal for SMEs and large organisations alike

- Potential risks include payment failures due to insufficient funds, setup delays, and fraud, but these can be mitigated with proper monitoring and account management

- Aspire allows you to make GIRO payments with zero fees through its multi-currency accounts, helping you save on local transfers

If you’re operating a business in Singapore, chances are you’ve encountered one of the payment methods known as GIRO. GIRO stands for General Interbank Recurring Order. It might sound a bit technical, but it’s actually a simple and convenient way to handle regular financial transactions for your business.

The meaning of GIRO is General Interbank Recurring Order. It’s a cashless payment method that is one of the go-to systems for managing things like utility bills, subscriptions, and supplier payments in a smooth, automated manner. By letting approved parties deduct payments directly from your business account, GIRO payment processing time is short and ensures you meet all the payment deadlines. It’s all about making your financial management more convenient and hassle-free.

Let’s take a closer look at how GIRO works.

What Is a GIRO Payment?

GIRO transfer, often referred to simply as GIRO, is an automated electronic payment service that allows your business to make payments or collect payments from your customers or other businesses directly from your bank account. It’s a popular method for conducting financial transactions, particularly in countries that support electronic banking systems.

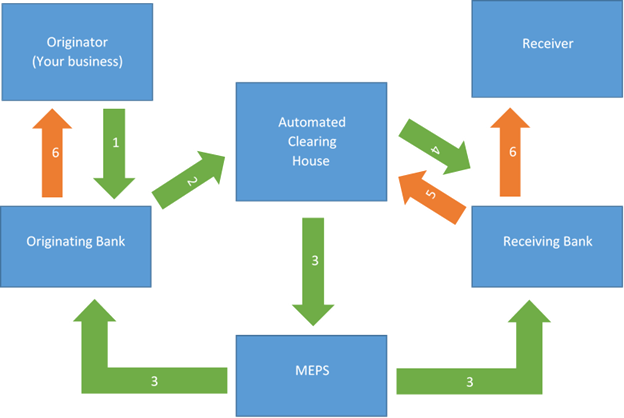

Interbank GIRO (IBG) or GIRO is a 3-way relationship between you, your bank and a billing organisation (BO). GIRO is an arrangement your bank provides for you to make payments directly to a BO for any outstanding bills. A BO can be a government agency or a private company.

*Image Reference: Association of Banks in Singapore

Now that you know what is GIRO payment, let's look at what are the services it offers your business.

The two primary services that GIRO offers for businesses and individuals:

- With GIRO direct debit, you permit a Billing Organization (BO) to withdraw funds from your designated bank account for consistent bill settlements. Bank account holders can use GIRO direct debit for consistent bill settlements

- Some banks extend “GIRO-on-demand” facilities, requiring you to authorise each individual GIRO payment either over the phone or through the Internet

How Does a GIRO Transfer Work?

Payment Authorisation

As a business, you start by creating payment instructions for transactions. These instructions outline the recipient’s account information, payment amount, and frequency (if recurring).

You submit these payment instructions to your originating bank. This bank reviews the instructions and checks factors like your available balance and credit limit (if applicable). For direct credit instructions, your bank ensures you have sufficient funds.

Deduction

If everything checks out, your originating bank sends the payment instructions to the Automated Clearing House (ACH). The ACH acts as an intermediary, coordinating the movement of funds between different banks.

The ACH calculates the net settlement amount for each participating bank involved in the transaction. This ensures that funds are accurately distributed among banks. The ACH shares the net settlement figures with the MAS Electronic Payment System (MEPS), which broadcasts the information and handles the final settlement of funds among banks.

The ACH forwards the payment instructions to the receiving bank (the recipient’s bank). This bank credits the second party’s account according to your instructions.

Payment Confirmation

If the payment instruction is successful, the receiving bank confirms the transaction, generating a credit statement for your business and a debit statement for the recipient. The instruction might be rejected if there’s an issue (like insufficient funds).

In case of rejection, the receiving bank sends the rejected instruction back to your originating bank via ACH. The ACH adjusts settlement amounts accordingly before forwarding the rejected instruction to your bank. Unsuccessful giro deductions can lead to the arrangement being cancelled and potential bank charges.

Overall, the GIRO transfer process streamlines payments for your business. It reduces manual intervention, enhances accuracy, and offers a convenient way to manage recurring payments.

What Are the Benefits of a GIRO Transfer?

Here’s why GIRO is an excellent option for businesses in Singapore:

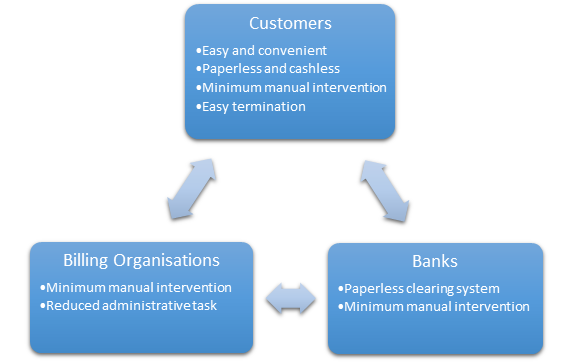

- It offers a smooth and efficient way to handle payments between all parties involved.

- Your business can enjoy a streamlined digital payment solution, including the convenience of easily cancelling a giro payment arrangement if needed.

- Monthly payments become a breeze, freeing you from the task of remembering due dates and eliminating the hassle of dealing with cheques.

- From a banking perspective, GIRO acts as an electronic clearing system, reducing the reliance on manual processes. This helps optimise resource allocation and operational efficiency.

- For billing organisations, GIRO simplifies administrative tasks and manual responsibilities, leading to increased overall efficiency.

*Image Reference: Association of Banks in Singapore

Examples of How Your Business Can Use GIRO Payments in Singapore

GIRO payments can make life easier for your business by automating payments and collections. Whether you’re paying suppliers, managing payroll, or collecting fees, GIRO helps you save time, reduce errors, and focus on growing your business. Here are some practical ways you can use GIRO:

1. Automate Your Payroll

Paying your employees on time is crucial, and GIRO makes it simple. You can set up monthly payments to go straight into their bank accounts without having to do it manually every month. This keeps your staff happy and ensures you never miss a payday.

Example:

Company A is a small-sized consulting firm whose headcount grew from 65 in 2024 to 170 in 2025. Previously, its finance team spent about 2days each month preparing manual transfers, such as crediting monthly salaries, reimbursing travel expenses, and paying CPF contributions.

However, as the number of employees increased, the team needed 3–4 days just to complete payroll processing. Frustrated by the long turnaround, the company set up GIRO payments through its bank, enabling salaries to be automatically disbursed to employees’ accounts on payday. The adoption of GIRO not only reduced administrative time from 16 hours to 3 hours per month but also improved employee satisfaction, as payments became consistently punctual.

2. Pay Your Suppliers on Time

Regular payments to suppliers, like rent, utilities, or stock purchases, can be automated with GIRO. You won’t need to worry about missing deadlines or paying late fees, which keeps your suppliers happy and your cash flow predictable.

3. Collect Payments from Customers

If you offer subscriptions, memberships, or installment plans, GIRO is a great way to collect payments automatically. It’s perfect for things like gym memberships, tuition fees, or recurring services. Your customers will find it convenient, and you’ll have fewer payment delays to deal with.

4. Handle Taxes and Government Fees

You can use GIRO to pay your taxes, licences, or contributions to CPF (Central Provident Fund). This way, you avoid the hassle of manual payments and ensure you meet all your deadlines, keeping things stress-free and compliant with government rules.

5. Repay Business Loans

GIRO can help you stay on top of your loan repayments. You can set it up to automatically deduct your monthly payments, so you don’t have to worry about missing one or paying late fees.

6. Reimburse Employee Expenses

If you need to reimburse your employees for expenses like travel or medical bills, GIRO can make the process faster and smoother. You can transfer the money directly into their accounts, saving time and keeping your team happy.

7. Collect School Fees or Donations

If you run a school or a non-profit, GIRO makes it easier to collect regular payments like school fees or donations. Parents and donors can set up automatic payments, giving you a steady and reliable income stream.

8. Pay Utility Bills

Running a business means dealing with bills for things like electricity, water, and phone services. GIRO ensures these bills are paid on time every month, so you can avoid service interruptions and focus on running your business.

9. Manage Business Partnerships

If you have a partnership or joint venture, GIRO can handle regular payments between your businesses, like revenue sharing or splitting costs. It’s a simple way to keep things fair and organised.

Key Considerations before Using GIRO Payments

Before setting up GIRO for your business, it’s important to assess whether it fits your operational and financial needs. Here are some key factors to keep in mind:

1. Plan Your Payments

GIRO arrangements aren’t instant. They can take several days or even weeks to activate, depending on your bank and the billing organisation. If you have upcoming payments due soon, plan ahead or make manual payments until the setup is confirmed.

2. Maintain Sufficient Funds

Since GIRO payments are automated, deductions will occur regardless of your current cash flow. Make sure you maintain sufficient funds in your account to prevent failed deductions, bank fees, or service interruptions.

3. Double-check Essential Information

Even small errors can cause major delays. Always double-check your bank account number, UEN (Unique Entity Number), and billing organisation code before submission. In Singapore, these details are essential for successful approval.

4. Set Up Payment Notifications

Set up transaction alerts and check your bank statements regularly. This ensures you can spot failed deductions or unauthorised activity quickly. While GIRO is generally secure, keeping an eye on your account helps prevent potential fraud.

5. Consider Alternative Payment Options

If your business requires more flexible, faster payments, you might combine GIRO with other methods like FAST transfers or PayNow Corporate, especially for one-off or urgent payments.

Understanding the Risks of GIRO Payments

GIRO payments are beneficial, but they’re not without their challenges. As a business owner, knowing what could go wrong and how to stay ahead is essential. Let’s look at some common risks and some expert tips on how you can avoid them.

Insufficient Funds

If there’s insufficient money in your account when a GIRO payment is due, it won’t go through. This could lead to late fees, strained relationships with suppliers, or service disruptions. To avoid this, keep a buffer in your account so payments aren’t missed.

Delays in Setting It Up

Setting up GIRO isn’t instant. It can take time to get everything approved. This might mean you’ll need to handle payments manually at first. To avoid delays, submit your requests well in advance and follow up if needed.

Limited Flexibility

GIRO payments are automated, which means once they’re scheduled, they’ll go through as planned. If your cash flow tightens, it can be tricky to postpone or adjust them last minute. Always review your payment schedules and ensure your finances are in good shape.

Setup Errors

Minor errors, like a wrong account number or payment amount, can cause big problems.

For example, entering the wrong account number, UEN (Unique Entity Number), or billing organisation code may result in failed deductions or payments being directed to the wrong party. In Singapore, many billing organisations, such as government agencies or large utilities, require you to input their UEN accurately when setting up GIRO. A single-digit error could delay approvals or even cause payments to bounce.

From our experience, we’ve seen clients make these errors and fail to complete their transactions. Therefore, we always suggest that you double-check all details during setup to avoid unnecessary headaches.

Overlooking Account Activity

When payments run on autopilot, it’s easy to lose track. You might not notice a failed transaction or a cancelled GIRO mandate until it causes problems. Make it a habit to review your account statements regularly.

Risk of Fraud

Although uncommon, unauthorised deductions can happen if your account details are exposed. Recovering funds can take time and effort. Protect your banking information and monitor transactions closely.

Trouble with Updates

If you switch banks, you need to change payment amounts or update schedules. This process takes time. Acting quickly on any changes ensures your payments stay on track.

Unexpected Delays

While it's rare, bank system downtimes can delay GIRO transactions. This might be out of your control, but being aware helps you prepare for any potential hiccups.

What Happens When There Are Not Enough Funds in your account for a GIRO Transaction?

- For complete information on their fees and charges, contacting your bank and the respective BO is advisable.

- In such instances, Billing Organizations (BOs) might notify you (bank account holder) about deductions that didn’t go through and provide a potential second deduction date.

- BOs may ask for different payment methods if needed.

- BOs can choose to recover bank charges from failed deductions and introduce fees to cover processing costs.

- Some banks might charge S$10 for each unsuccessful GIRO deduction in Singapore due to insufficient funds.

What to Do If GIRO Deductions Are Incorrect

Here’s what to do if something goes wrong with a GIRO deduction:

Before the Deduction is Made

- Contact the Billing Organisation (BO):

- Act quickly and inform the BO (e.g., your landlord or supplier) about the issue.

- Request them to suspend the deduction while they investigate.

- Outcome After Investigation:

- If the error is valid, the BO will adjust the amount before processing the deduction.

- If the amount is correct, the deduction will proceed as planned.

Let's say for example, you notice your rental payment is set higher than usual. Contact your landlord immediately to pause the deduction. If it’s an error, they’ll fix it; otherwise, it will go through as scheduled.

After the Deduction is Made

- Clarify the Issue:

- Check with your bank and the BO to determine where the error occurred.

- Investigation Process:

- The BO will acknowledge the issue within 3 working days.

- They will provide an interim response within 10 working days.

- Refunds and Corrections:

- If the BO made the error, they will refund the difference.

- If the bank deducted the wrong amount, they will investigate and correct it.

For instance, your utility bill deduction is much higher than usual. Contact your utility provider and the bank. If the utility company made the mistake, they’ll refund you. If the bank is at fault, they’ll fix the error.

How Does a GIRO Transfer Differ From an Instant Transfer?

How Long Does a GIRO Transfer Take in Singapore?

Typically, transfers are done in up to two business days, but you may want to ask your bank how long it usually takes for transfers.

Sometimes GIRO Singapore transfers are processed in groups, making them slower. If you do a transfer on a weekday, it usually goes faster than on weekends or holidays when banks might not work as much. Different banks might also work at their own speeds.

How to Sign Up Your Business For a GIRO Transaction in Singapore?

- Get the Form: You can usually find the GIRO application form on the organisation's website you want to pay using GIRO. You can also contact them directly if you don't find the form online. And if you want to receive money via GIRO, it would be the same process.

- Fill Out the Form: Complete with your business and bank details. For example: If you're applying for GIRO to receive payments into your Aspire Account, you might need to complete a GIRO Credit Authorisation Form.

- Submit: Send the filled form back to the organisation.

- Wait for Approval: They'll review and approve your application. Generally, your GIRO application should get the green light within 14 working days after you've submitted it, assuming you've correctly filled out the form. The BO in charge will inform you when they'll make the first GIRO deduction.

- Confirmation: Once approved, they'll notify you and provide details about the first deduction.

- Ensure Funds: Ensure you have enough funds in your account on the deduction date.

- Monitor: Keep an eye on your bank statements for deductions.

Remember, at the moment, setting up a GIRO arrangement doesn't come with any fees or charges. Also, Government entities (like Vendors@Gov) might not allow payments to third-party virtual accounts even if you've endorsed the GIRO Singapore DCA form.

eGIRO: Meaning and how it simplifies the GIRO Account Setup Process

With eGIRO, the Association of Banks in Singapore, along with eight leading banks, has built a transformative initiative to achieve Singapore's goal of becoming a smart financial hub. This innovative scheme was launched on 8th November 2021 and presents a novel way to streamline and expedite the application for GIRO payments in Singapore.

These eight participating banks are:

- Bank of China

- DBS Bank/POSB

- HSBC Bank

- Industrial and Commercial Bank of China

- Maybank

- OCBC Bank

- Standard Chartered Bank

- UOB

The eGIRO service simplifies the process of setting up GIRO by using cloud technology, microservices, and APIs. This results in a seamless and trouble-free experience for customers, banks, and billing organisations.

The GIRO application process demands 3-4 weeks for completion from start to finish. But now, with the eGIRO process, you'll find that the turnaround time is significantly reduced to just minutes for consumers and less than 48 hours for corporate accounts with designated approvers. This is because eGIRO is available 24/7.

How it works:

- Choose Your Bank: Start by selecting the bank through which you'd like to process your GIRO payments. This step ensures your payment process aligns with your preferences.

- Online Banking Login: Access your selected bank's net banking page. Once there, you can easily indicate the specific account you wish to use for vendor payments.

- Confirmation of Success: After completing the above steps, you'll receive a confirmation that your GIRO application was successful. This assurance gives you the confidence that your payment arrangement is set up as intended.

The benefits of eGIRO

- Quick Processing Time: Experience rapid transaction processing, ensuring payments are handled promptly.

- Faster GIRO Setup: Set up GIRO payments in less time with eGIRO, making the process efficient.

- Easy and Secure Setup: Enjoy a seamless and highly secure setup process for peace of mind while ensuring your data's safety.

- Almost Instant Payments: Make payments almost instantly with eGIRO for added convenience and control.

- Immediate Setup and Confirmation: Set up payments quickly and receive instant confirmation with eGIRO, empowering you in managing your finances.

- Swift Payments for Billers: Billing organisations using eGIRO can collect payments within a day, ensuring speedy processing for financial transactions.

GIRO Transfer Cut-off Times

GIRO transfers are available every day from 4:30 am to 12:00 am (midnight). Here's when the beneficiary will receive the funds based on the time you initiate the transfer:

Business Days (Monday to Friday)

- Before 5:00 am: Funds received same business day by 11:00 am.

- 5:00 am to 8:00 am: Funds received same business day by 2:00 pm.

- 8:01 am to 11:00 am: Funds received same business day by 5:00 pm.

- 11:01 am to 2:00 pm: Funds received same business day by 8:20 pm.

- 2:01 pm to 5:00 pm: Funds received same business day by 11:00 pm.

- After 5:00 pm: Funds received next business day by 11:00 am.

Non-Business Days (Saturday, Sunday, and Public Holidays)

- All transfers initiated on non-business days will be processed on the next business day by 11:00 am.

Unsuccessful Transactions

- If a GIRO transfer fails but was made on the same day before 5:00 pm, the funds will typically be returned to you by 11:00 am on the next business day.

Example Scenarios

- You initiate a GIRO transfer at 6:00 am on a Wednesday—the recipient will get the funds by 2:00 pm on the same day.

- You make a transfer at 9:00 pm on a Friday—the recipient will get the funds by 11:00 am on the following Monday (or the next business day).

Keep these timings in mind to plan your payments and avoid delays!

How Can My Business Terminate a GIRO Arrangement?

GIRO operates as an agreement between your business and its service provider – the Billing Organisation (BO). It streamlines payment processes through your designated business bank account. Within this setup, your business authorises the bank to settle bills, typically regularly, by debiting the account as per the BO's request.

Should you decide to stop a GIRO payment, informing the BO and your business bank is crucial. This ensures that the BO stops requesting payments from your bank, and your bank ceases processing deductions for that specific payment.

Take note that inactive or dormant GIRO authorisations don't terminate automatically. Your business needs to end the GIRO arrangement proactively. This may involve sending a written notice to the BO to communicate the decision and simultaneously notifying the bank of the GIRO authorisation termination.

Maximise Payment Efficiency with Aspire’s Multi-Currency Business Account

Think of a multi-currency business account as your complete financial toolbox, designed to make finance management smooth and easy. This account allows you to send, receive, and withdraw funds as needed. Whether you use corporate cards or make transfers through GIRO, your funds are easily accessible. While there might not be a physical branch, reliable customer support is just a click or a call away.

Additionally, Aspire's multi-currency corporate cards are a smart way for businesses to handle finances. Forget about extra fees with our free local transfers. These cards also offer better currency exchange rates than traditional banks, helping you save money. You can use them to spend in foreign currencies when it's important for your business. Sending money globally is hassle-free, with low transaction fees.

Aspire’s corporate cards also offer 1% cashback on digital marketing and software as a service (SaaS) spending. Enjoy security features like card freezes and customisable limits. Plus, you can create virtual cards for your team at no extra cost.

Apply now for the Aspire multi-currency business account. It's a step forward in managing your finances wisely.

Frequently Asked Questions

Can I apply for GIRO if I do not have sufficient funds in my account at the point of the application?

Yes, you can apply for GIRO even if you don’t have sufficient funds at the time of application. However, ensure that your account has enough funds when the first deduction is scheduled, as insufficient funds can lead to a failed transaction.

How do I know if my GIRO application is approved?

Once your GIRO application is processed, you’ll typically receive a notification from your bank or the billing organisation (BO). Approval timelines can vary but usually take a few working days. You can also check the status of your application through your bank’s online banking platform or by contacting the BO directly.

What are the common reasons for a rejected GIRO application?

- Incorrect Account Details: Ensure the bank account details you provide match your records.

- Insufficient Funds: Having insufficient funds during the approval process can lead to rejection.

- Bank Account Restrictions: Some accounts may not be eligible for GIRO (e.g., joint accounts requiring multiple signatures).

- Inaccurate Billing Organisation Details: Double-check the billing organisation’s code and reference number.

Do I receive any transaction alerts on my monthly GIRO deductions?

Yes, most banks provide transaction alerts via SMS or email when a GIRO deduction is made. You can set up these alerts through your online banking settings if they are not already enabled.

How would I know that my GIRO arrangements have been terminated?

You’ll typically be notified by your bank or the billing organisation if your GIRO arrangement is terminated. Reasons for termination can include:

- The BO or bank cancels the arrangement due to inactivity.

- Repeated failed deductions due to insufficient funds.

- You manually terminate the GIRO arrangement through your bank.

- Always confirm termination by checking your bank statements or contacting the BO if you suspect an issue.

- The Association of Banks in Singapore - https://www.abs.org.sg/e-payments/

- Channel News Asia - https://www.channelnewsasia.com/singapore/egiro-service-shorten-application-mas-2297866?

- Inland Revenue Authority of SIngapore - https://www.iras.gov.sg/quick-links/forms/other-taxes-and-services/giro-application-forms

%201.webp)

.webp)