Summary

As technological advancements seep into the financial sector, more companies are popping up to offer convenient financial services. One of the most popular branches of this digital disruption is Neobanks. Singapore is home to numerous neobanks. This buzzword has gained prominence in the fintech community, and it seems like a novel idea, a new bank. But what is a Neobank?

What is a Neobank and how do they work?

A neobank is a financial institution that operates entirely digitally with no physical bank branches. Typically, they run through an online platform such as a website, a smartphone application, or even both.

Most importantly, they offer digital and mobile-first financial solutions for payments, transfers, loans, and more. Additionally, they allow customers to make deposits, withdraw funds, provide debit cards, investment opportunities, and more. They also provide banking, financial services and Insurance (BFSI). However, most Neobanks need a banking license from the Monetary Authority of Singapore (MAS) and most Neobanks collaborate with licensed banks as partners to provide financial services.

Neobanks in Singapore leverage the modern-day technology to enhance convenience. They provide financial products such as foreign transfers, credit lines, and payment solutions for individuals and businesses.

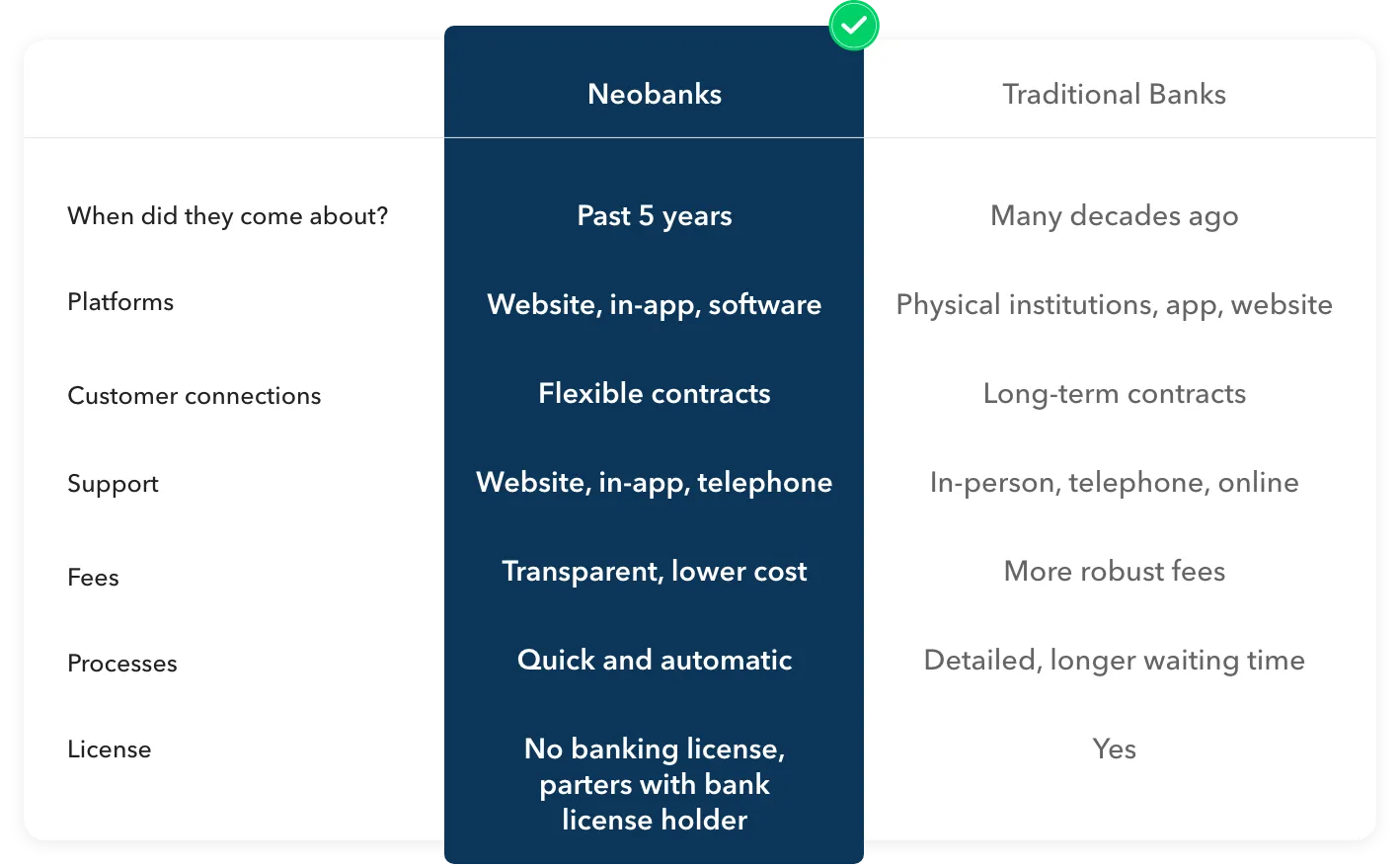

What are the differences between Neobanks and traditional banks in Singapore?

Traditional banks are well-known for having a robust and regulated financial system. Their trustworthiness has made banks the first place that comes to mind when consumers think of financial services.

However, as customer experience and satisfaction are pushed to the forefront of the financial landscape, a traditional bank might need help to cope with its rigid systems and rapidly evolving consumer demands. The same operating systems put in place now leave little to no room for innovation.

Here's where Neobanks differ. The slimmed-down business model of a Neobank allows it to target its intended audiences more effectively, reducing fees and increasing perks. Against an increasingly digitised generation, Neobanks offer quick solutions to the financial needs of up-and-coming businesses and consumers.

Whether tracking business finances or transferring money to a family member overseas, Neobanks are slowly infiltrating the financial sector.

Here’s a quick look at the differences between neobanks and traditional banks in Singapore:

Importance Of Neobanking For Businesses

The International Data Corporation (IDC) helps you understand the challenges facing small and medium-sized enterprises that rely on the traditional financial system. The average annual loss SMEs incur, depending on the legacy system, is 1073.21 SGD per SME.

Businesses relying on legacy systems often have to do their banking the traditional way i.e. manually, risking repetition, error and unnecessary delays. Companies, especially SMEs, will greatly benefit from the switch to Neobanking.

What are the advantages of using a Neobank?

There are many advantages of neobanks, but here’s a rundown of the most alluring features of one:

1. Convenient and Accessible

Smartphone penetration rates are estimated to reach 4.65 million in Singapore in 2020, which means over 90% of people in Singapore use smartphones in today's digital age.

Leveraging on the tech-savviness of its consumers, neobanks uses algorithms and cloud-based tools to provide efficient and accurate financial services—all through a mobile application. With just a click of a button, consumers will be able to bypass the many processes required at a traditional bank.

The wealth of information that traditional banks provide might sometimes be confusing to those who have limited financial awareness. Neobanks break down financial processes into digestible bite-sized pieces, offering easy access to services such as loans, and peer-to-peer transfers.

2. Lower Account Fees

As neobanks don't have physical branches, they have a significant cost advantage in operation. These cost savings are translated into lower application, account, and programme fees for their customers.

To give you an example, opening a business account with a traditional bank usually requires a minimum deposit and minimum monthly balance. This could be a hefty sum to fork out for a small business looking to get its feet off the ground.

Neobanks have less administrative costs than banks do, so opening a business account with a neobank provides more value for money. On top of that, neobanks often offer lower FX rates and transfer fees, great for SMEs and startups looking to expand overseas.

Another significant advantage of utilising a neobank is the absence of fees associated with various services. Many neobanks do not impose monthly service fees or overdraft fees. Most neobanks allow you to open a bank account with no minimum balance, simplifying money management and alleviating concerns about unexpected charges.

💡 Tips: From monthly minimum balance to fall-below fees, such account fees could quickly add up to your business expenses. Choose a business account with low account fees to generate more savings.

3. Personalised customer experience

While traditional banks do offer a host of financial products such as credit cards, insurance and loans to a general audience, neobanks target more specific audiences. Examples include creating products that work on payrolls, expense management and automated accounting services for freelancers.

Neobanks also often offer add-on products as a way to offer solutions to corporate finance challenges SMEs face. Integrating APIs into their platform is just one of the many ways neobanks help to streamline business workflows.

Being entirely online, neobanks are able to analyse customer behaviour and pain points through data-driven processes easily. This provides an avenue for neobanks to update their interface, swiftly making their platform ultra-user friendly.

Why are neobanks still rare in Singapore?

Despite the buzz around neobanks, they’re still relatively new in the country, as Singapore is a place where financial regulations are rife. As such, many fintech startups looking to incorporate or obtain a license in Singapore might face a few hurdles.

Neobanks aren’t required to hold full-banking licenses. Instead, they could partner with a license-holder bank or leverage on alternative license types to provide bank-like products through an application. These differ from the full-banking licenses that challenger banks such as Revolut possess.

In Singapore, the presence of a Digital Bank Licensing scheme has encouraged larger tech giants to enter the digital challenger bank arena. However, the barriers to entry for a digital bank license are high, with high capital requirements being one of the discouraging factors for smaller digital banks to contest licensing regimes.

With that in mind, this has led to a higher presence of Non-Financial Institutions and Consortium led challengers rather than neobanks.

Should You Consider Switching To A Neobank?

The appeal of Neobanks is immediately apparent as more and more customers seek digital financial services. It's convenient to perform routine tasks like carrying out peer-to-peer payment transfers online without having to incur a barrage of fees. The agility of Neobanks, which typically faces fewer regulatory hurdles, often results in easier account setup and faster processing times. They are easy to use, less time-consuming, user-friendly and lend power into the hands of the users by making mundane tasks seem straightforward and efficient.

Neobanks often work with regular banks, which are members of the Singapore Deposit Insurance Corporation (SDIC), to maintain regulations and ensure the security of your funds. The name of the deposit insurance company might vary depending on the region, but the system is the same throughout.

In Singapore, all digital banks partner with traditional banks to provide financial services and to keep the customers' money in one bank account. Money deposited in a digital bank account is just as safe as that deposited in a standard bank account, as a traditional bank hosts the underlying account.

However, Neobanks are best suited for SMEs & startups. Usually, the number of financial services a Neobank offers might be lesser than traditional banks. Their credit limits might be lower than those of traditional banks. They focus more on fundamentals like checking and savings accounts than on offering mortgages and other types of credit. Unlike traditional banks, neobanks have no physical branches where the customer can avail in person services and support.

Whether you opt for a Neobank or a traditional bank for your financial services, both will provide economic tools to run your business processes and carry out your daily activities. If you're a traditional business owner, a brick-and-mortar bank can offer you financial solutions more suited to your company. But if you're a startup owner looking to automate and cut down on chunky financial processes, Neobanks might have your dream product up their sleeves.

Popular Neobanks in Singapore?

Neobanking might still be pretty new to Singaporeans, but here are a few neobanks in the country that you should keep a lookout for:

1. Wise - Neobank for International Money Transfer

Established in 2011, Wise, formerly Transferwise, is one of the world’s leading neobanks for internal transfers.

Users of Wise enjoy low international transaction fees and exchange rates, making it an amazing alternative for both businesses and consumers looking to transfer funds overseas.

The platform also offers international business account opening, which allows businesses to pay invoices and handle payroll in over 40 currencies. Now integrated with Aspire, users can enjoy Wise’s low-cost and fast international transfers through their accounts.

💡 Tips: Did you know that Aspire became Wise’s first integration? With the Aspire Business Account, you can enjoy direct international money transfers with the lowest exchange rates.

You can open a Wise account at no cost without requiring a minimum balance. There are no monthly charges, concealed expenses, or extra fees for currency conversion. With the ability to hold over 50 currencies and seamlessly switch between them at the mid-market exchange rate, you can use your connected Wise card to purchase in over 170 countries worldwide.

2. Youtrip - Neobank for Multi-Currency Mobile Wallet

This neobank has made waves amongst travel-addicted millennials. Youtrip is a neobank that offers a multi-currency travel wallet. Super fuss-free and easy to use, Youtrip allows users to make overseas transfers with no fees in over 150 currencies. The exchange rates offered by Youtrip are linked to real-time exchange rates, making them much better than the FX rates offered by banks.

Say goodbye to queueing up at your local money changer for good. Youtrip also provides an in-app money changer for 10 major currencies that works 24/7, allowing you to lock down competitive exchange rates weeks or months in advance.

Furthermore, there's no need for you to uphold a minimum balance to keep your YouTrip account active. You can simply fund your account with your YouTrip card whenever you need to make payments.

3. Revolut - Neobank for Global Money App

Revolut is a neobank that allows users to spend multiple currencies and transfer money internationally. Similar to Youtrip, Revolut offers ultra-low exchange rates and no transaction fees.

However, Revolut also comes with an in-built expense tracker, which allows you to categorise spending and budgeting. Revolut currently has three different plans: Standard (free), Premium, and Metal. Although Premium and Metal come with an additional charge, they do provide extended limits and more features.

The Revolut Standard card comes with no obligation to maintain a minimum balance or pay a monthly plan fee. With this plan, you can handle your expenditures and international transfers without worrying about concealed fees.

How To Choose A Neobank For Your Business?

You should think about a few distinct criteria when comparing different Neobanks to decide which one will best suit your needs:

1. Products available: You can check products and services that your brand uses the most and their availability with the Neobank. Moreover, you can see the bank's website to determine whether the items they provide satisfy your needs or whether you should continue looking for a bank with more to offer.

2. Interest rates and fees: Depending on the objective of your account, you should examine the fees and interest rates offered by each bank to decide which Neobank will best assist you in achieving your future goals. Choose a Neobank that provides a competitive rate on a high-yield savings account or Certificate of Deposit (CD) if the goal is to increase your money. The availability of a no-fee checking account may be particularly important if the Neobank will be used for regular expenses.

3. Deposit insurance: Because not all banks are SDIC (Singapore Deposit Insurance Corporation) members, you should ensure the bank your Neobank is associated with is an SDIC member.

4. Customer service channels: You can research the types of customer service alternatives each Neobank provides, including chat, phone, email, or text help, as well as their operating hours. You should be aware of your options if you ever find yourself in a scenario where you require assistance or have inquiries about your account.

5. Reviews and ratings: Go to the app store on your phone to read reviews of the Neobank app, which may serve as your primary platform for banking needs.

%201.webp)

.webp)